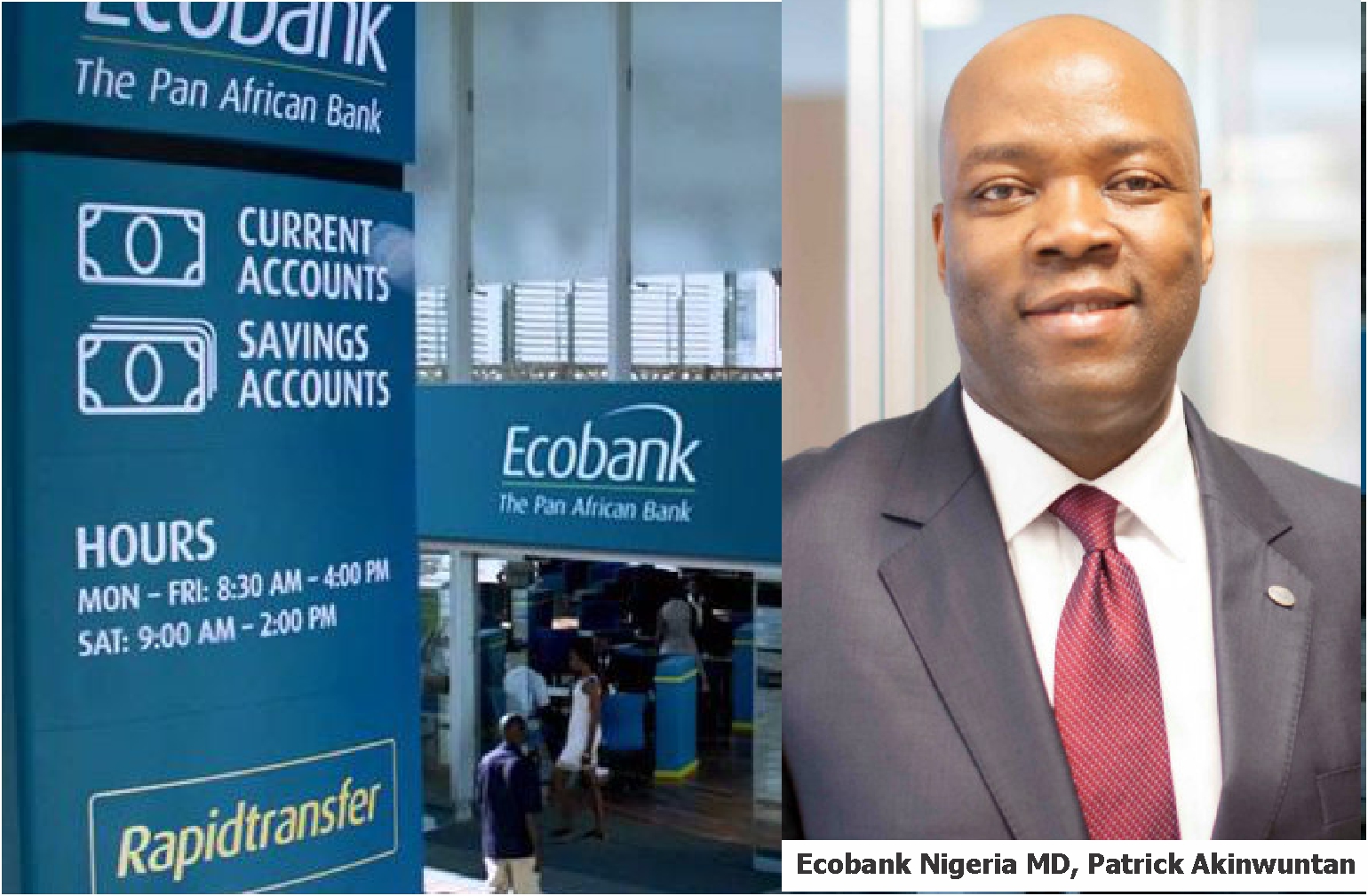

Managing Director, Ecobank Nigeria, Patrick Akinwuntan has said the introduction of the Nigeria Quick Response (NQR) code payment solution by the Nigeria Inter-Bank Settlement System (NIBSS) is strategic and timely as it will encourage contactless payments while also aligning to the Central Bank of Nigeria (CBN)’s goal to drive a cashless economy.

Akinwuntan, while congratulating NIBSS said that Nigerian digital payment is aligning with global standards as consumers, business owners and financial services providers will benefit from the innovative payment platform.

NIBSS had announced the launch of the NQR payment solution, which is an innovative payment platform implemented on behalf of all financial service providers. The NQR code solution offers a robust platform that delivers instant value for Person to Business (P2B) and Person to Person ( P2P) transactions by simply scanning to pay. It is a solution that will unify the available closed QR Code schemes in the country for consistent user experience and accelerated digital adoption.

According to him: “The Nigerian digital payment space has been evolving over the years in response to global payment trends and with this comes an increasing demand of alternative means of payment digitally as customers and merchants alike move towards technology driven solutions. The adoption of QR payments across the world is a testimony to QR being the future of digital payments.”

He noted that Ecobank has been on the forefront of the QR digital payment solution in Nigeria: “Ecobank is delighted to be among the first few banks in Nigeria to bring this solution to its customers. We have recently integrated with the NQR payment solution because we believe this will enhance interoperability with existing QR schemes and promote consistent user experience. I say a big congratulation to NIBSS.”

Nigeria’s financial services industry witnessed a significant shift with the formal launching of the NQR payment solution by NIBSS last week. The event conducted in a hybrid format (virtual and physical following COVID 19 protocols) brought together stakeholders in the financial services, technology industry, regulators, and policymakers.

At the launch, Deputy Governor, Financial Systems Stability CBN / Chairman, NIBSS, Mrs. Aishah Ahmad, commended the NIBSS team for this trailblazing achievement.

She stated: “The CBN as regulator of the banking and payment system in Nigeria is committed to providing an enabling regulatory environment that ensures interoperability, proper market conduct and continued innovation within the financial services ecosystem to foster healthy competition, high-quality service and financial inclusion. Against this background, the apex bank recently released of the Regulatory Framework for Sandbox Operations in Nigeria and the Guidelines on Open Banking with the objective of opening up the terrain for more transformative ideas and encouraging start-up companies to grow and contribute to the overall economic development in Nigeria.”

On his part, the Chief Executive of NIBSS, Mr. Premier Oiwoh said: “With more people being able to pay for goods and services with just their smartphones, the ‘NQR Payment is about re-creating the Nigerian payment experience whilst deepening financial inclusion in the country. Digital transactions supported through the NQR code payments will promote and enhance consumer payment experience while driving growth for business owners.”

The NIBSS NQR code, according to stakeholders would transform the landscape of the Nigerian payment ecosystem and improve areas like micropayments that would have a positive impact on merchants and businesses. The NQR payment solution implemented on behalf of financial services providers would unify the available closed QR Code schemes in the country.