David Oyekan (not real name) has three investment portfolios worth over a million naira with Agropartnerships, an agricultural investment platform powered by Farmforte, its parent company.

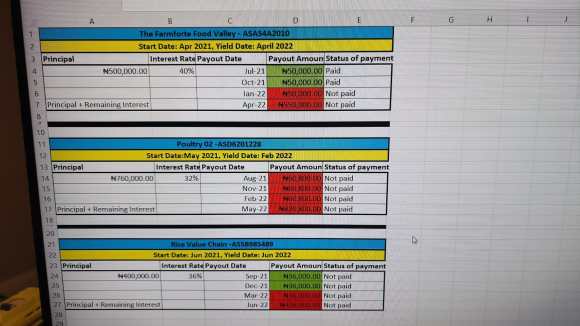

When he first invested with a capital of N500,000 in April, 2021, Oyekan received the interests promised by the company on a regular basis.

The ease with which the profits were paid spurred him into opening two additional portfolios with the firm.

However, things took a different turn when Farmforte would stop paying its customers both their capitals and the Returns on Investment (ROIs) promised at the beginning of 2022.

OYEKAN’S TALE

Oyekan’s first investment with Agropartnerships saw him purchase the FarmForte Food Valley at a cost of N250,000 per unit.

For this plan, investors were expected to get a 10 per cent ROI on a quarterly basis. They also had the choice of deciding whether they would love to roll over their capital at the expiration of their investment tenures or terminate it.

“When I started the investment in April 2021, I would always receive a payment of N50,000 at the end of every three months. That was like a 10 per cent quarterly payment on my capital,” Oyekan told FIJ.

“However, at the beginning of 2022, when I was supposed to receive my third quarterly ROI, nothing came in for me. Since then, the firm has not paid me a dime. Right now, It is not even certain whether I would still get my capital back also or not. I am really scared.”

Oyekan also said he was unsure whether he would ever get his N500,000 capital back from the company.

OYEKAN’S OTHER INVESTMENTS

After receiving the first part of his interest for Farmforte Food Valley in July 2021, Oyekan felt encouraged by the timeliness of the profit payment. As a result, he thought it would be a nice idea to further invest on another product that was on offer by the firm.

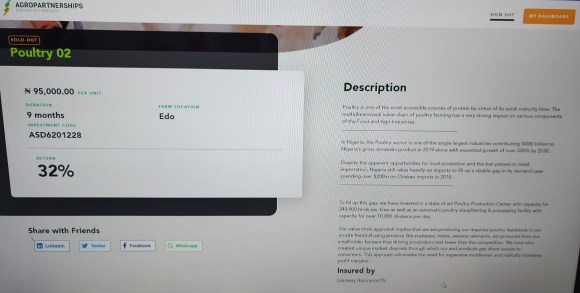

This time, he invested a N700,000 capital on Agropartnerships’ Poultry 02 Investment. He also placed another N400,000 capital on the firm’s Rice Value Chain.

Till date, however, Oyekan has only received a combined ROI of N72,000 on both investments.

“The returns for the Poultry 02 plan are to be received at the end of nine months. Then, we collect the capital and the interest,” he said.

Just like the Food Valley investment, Oyekan also fears he may not be able to get his capitals back from Farmforte.

“I am concerned that we have seen different patterns like this before, where the CEOs run off with investors’ billions. This is Nigeria, I have seen huge investments disappear,” he said.

“I have over a million naira with the organisation, imagine the thousands of people who also have their millions with them. This organisation must be held accountable.”

NOT A SINGLE STORY

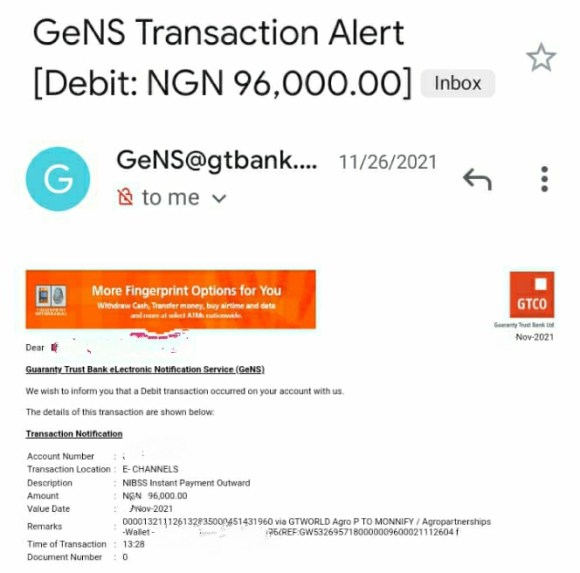

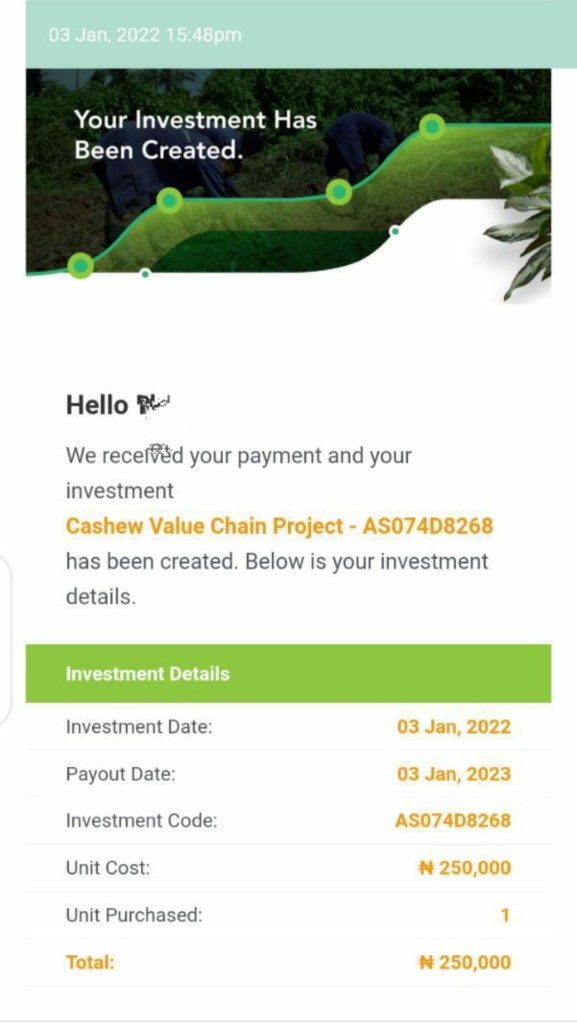

Lawal Seyi (not real name), another investor, who spoke to FIJ, also narrated how he had invested N96,000 in the firm’s Poultry 02 plan in 2001, and N250,000 in its Cashew Value Chain in January.

“I haven’t received any interest on my investment. The worst part is that, now I can’t even log into my account again,” Seyi said.

Presently, Seyi is worried about how he would be able make a withdrawal from the special e-wallet the firm had created for every investor if the company eventually starts paying again.

“I am not the only one who has not been able to log in. It’s like they wiped out our account. We keep getting the message ‘incorrect log in details’ despite entering the right details,” he lamented.

Seyi also stated that the only proof that most investors have of their dealings with the firm is the email address they were assigned at the point of registering for the investment.

His inability to log into his account is his greatest fear. He believes the firm’s management might one day run off with investors’ money without anyone stopping them.

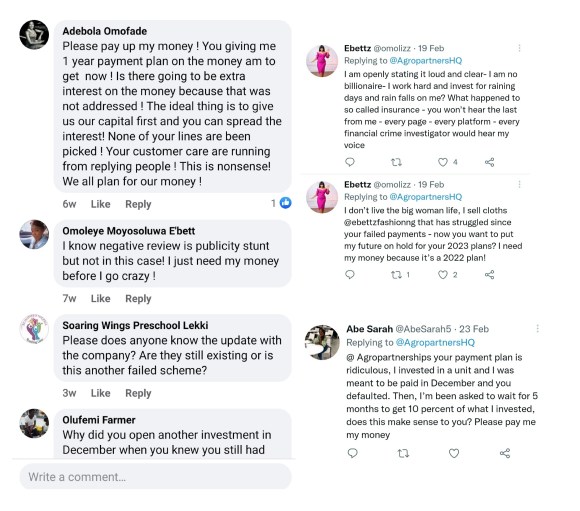

A quick scan of Agropartnerships’ social media pages also shows that the firm is currently sitting on thousands of investors’ capitals. In the comments section are various investors calling for their money to be released. Many, like Oyekan, started their investing in the firm last year.

FIJ’ S FINDINGS

On January 21, Agropartnerships released a statement about the delay in payment. However, one aspect that led to discontent among investors was the part of the the release that stated that the business was going “100% remote due to “the rapid spread of new COVID-19 variants”. This meant the firm would shut down its offices and would only maintain a remote relationship with its many customers.

However, on March 14, The Securities and Exchange Commission (SEC) announced that Agropartnerships’ office was one of those sealed for carrying out investment operations that fall within the ambit of fund management without registration.

https://twitter.com/SECNigeria?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1503378036191805448%7Ctwgr%5E%7Ctwcon%5Es1_&ref_url=https%3A%2F%2Ffij.ng%2Farticle%2Finvestors-billions-traped-with-agropartnerships-osayi-osazuwa-uyi-osayimwense%2F

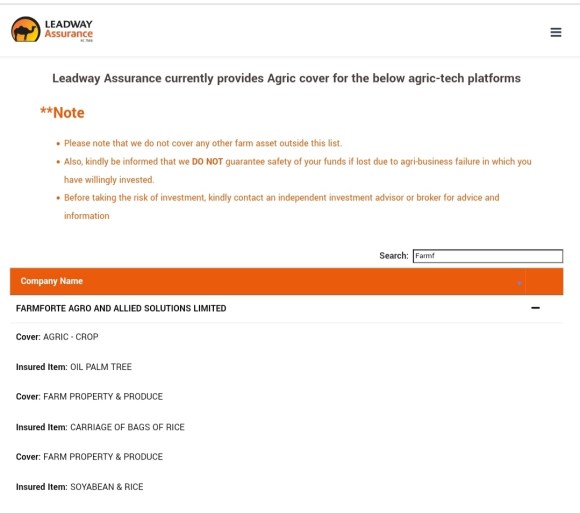

Additionally, on Agropartnerships’ website, each of the investments carry a notice to show that they are insured by Leadway Assurance Plc. However, FIJ’s visit to the insurance’s company’s website revealed no such information.

While Farmforte, the parent company of Agropartnerships is under Leadways’ Agri-Tech partnership, Agropartnerships is not. Even for Farmforte, very few of the produce they deal in are insured.

When FIJ reached out to Babatunde Raimi, an insurance expert, to confirm if a parent company’s insurance can cover other subsidiaries they power, like in the case of Farmforte’s insurance, he said such is impossible.

“The insurance for each company doesn’t cover each other. People only indicate this to trick people,” he said.

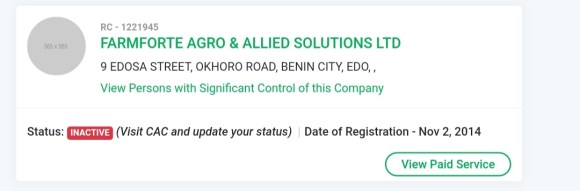

Interestingly, although Farmforte is registered, the company is currently inactive on the CAC site. The implication of this is that the business has not filed its annual returns up to date.

AGROPARTNERSHIP’S RESPONSE

FIJ’s efforts to reach Agropartnerships through text and calls were futile. However, in a recent report, the firm said payouts would resume in July, a period people like Oyekan would be eagerly looking forward to.

On February 18, the company’s leadership held a webinar where it announced the release of a new payment system. This payment system would halt all payouts for five months, starting from February 18.

At the meeting, Uyi Osayimwense, co-founder and co-chief executive officer of Agropartnerships, also told stakeholders that the company was working relentlessly to strengthen its pillars for longevity.

“I can assure you that everyone has worked tirelessly with us and our internal teams to fully analyse the situation – past and future maturing cycles, operations, future cash flows, risks, and opportunities,” he said.

“It is based on the outcome of this deep assessment that we have come up with the most viable way out of the present challenges.”