…withdrew case to avoid embarrassment

Documents have emerged indicating why the Economic and Financial Crimes Commission (EFCC) withdrew its celebrated case against Kogi State Government on a N20 billion salary bail-out fund alleged to have been fixed by the state government.

The EFCC had, last August, accused top officials of the Kogi State Government of diverting the N20 billion bailout loan channeled through Sterling Bank and fixing same with the bank instead of using the funds for the purpose for which it was meant.

The Commissioner for Information in the state, Kingsley Fanwo, had, however, strongly rebuffed the EFCC, insisting that the funds were judiciously utilised as stipulated for salaries, wondering how funds that had been disbursed could still be fixed.

However, despite its earlier claims of hard evidence on the alleged diversion of the funds, the EFCC by mid October, 2021 went to court to discontinue the case for the forfeiture of the alleged N20 billion it claimed was fixed in Sterling Bank.

Documents emerging have shed some light on why the EFCC might have made a quick turnaround on the issue.

In a letter written by Sterling Bank to the Kogi State Commissioner for Finance, dated September 1, 2021, titled, RE: REQUEST FOR CLARIFICATION REGARDING CERTAIN ALLEGED TRANSACTIONS WITH YOUR BANK BY THE KOGI STATE GOVERNMENT BEING INVESTIGATED BY THE ECONOMIC AND FINANCIAL CRIMES COMMISSION (EFCC)”, the Bank, which said it was “surprised and dismayed at the media narration surrounding the transactions, said, “In the light of the above submissions, permit us to respond to your enquiry as follows:

“The Kogi State government does not currently operate or maintain a fixed deposit account with Sterling Bank.

“There is no mandate letter from the Kogi State government to open account number 0073572696 with Sterling Bank.

“Sterling Bank account 0073572696 is an internal (mirror) account operated by the Bank for purposes of managing the Kogi State salary bailout facility.”

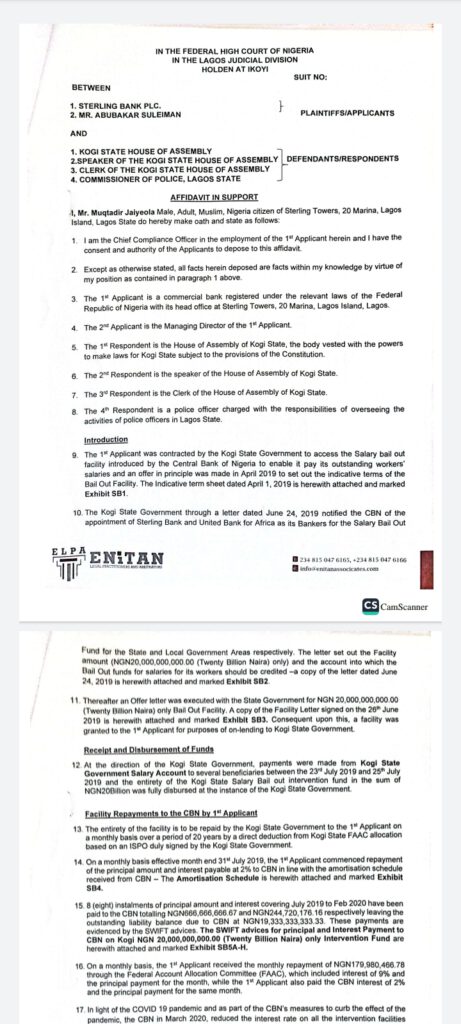

Another crucial evidence that seems to have completely changed the narrative was the affidavit deposed to by the Chief Compliance Officer of Sterling Bank, Muktadir Jaiyeola, with the Managing Director of the Bank as 2nd applicant, in a suit on the matter filed at a Federal High Court, sitting in Ikoyi, Lagos, on December 1, 2021.

The affidavit came upon repeated invitations by the Kogi State House of Assembly to the bank to clear the air on the allegations by the EFCC against the government.

Sterling Bank, in the affidavit, sighted by this paper, contrary to the claims of the EFCC, indicated that the Kogi State Government did not fix any N20 billion with it and confirmed that the funds alleged to have been fixed were fully disbursed to several beneficiaries at the instance of the Kogi State Government.

In Paragraph 12 of the affidavit, the Bank said, “At the direction of the Kogi State Government, payments were made from Kogi State Government Salary Account to several beneficiaries between the 23rd July 2019 and 25th July 2019 and the entirety of the Kogi State Salary Bail out intervention fund in the sum of NGN20 Billion was fully disbursed at the instance of the Kogi State Government.”

Frowning at repeated invitation sent by the state House of Assembly to the Managing Director, asking him to appear in person, the Bank further exonerated the state government.

In Paragraph 23 of the affidavit, the Bank reiterated that there was nothing like a fixed deposit account opened by the Kogi State Government for the bailout fund as stated in its September 1, 2021 response letter to the state.

“There was no mandate to open the alleged fixed deposit account;

“The Kogi State Government did not operate a fixed deposit account;

“The account referred to as a fixed deposit account is an internal account operated for the purpose of managing the bail out facility,” Sterling Bank said.

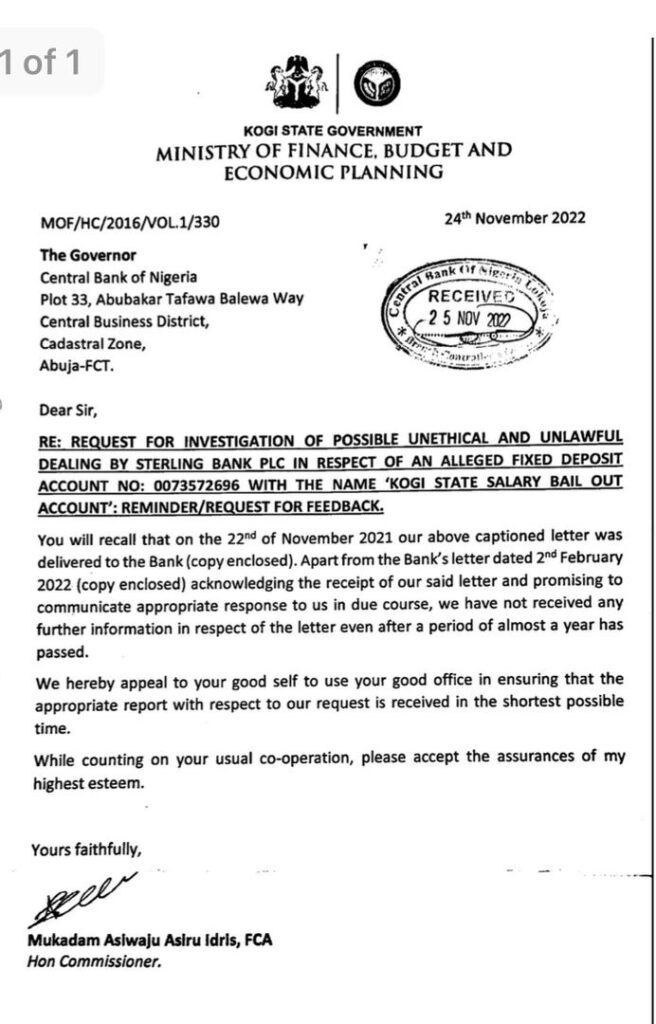

Following the cold trail in the investigations into the alleged diversion of the bail-out fund, the state government, through the Commissioner for Finance, Mukadam Asiru Idris, in a letter dated 24th November 2022, almost a year after an initial letter to the CBN to clear the air, reminded the bank to clear the air over the issue and make its investigations public, but it reportedly got no response till date.

The Kogi State Government alleged, on Thursday, that the fresh media trial by the EFCC was in continuation of the Commission’s “Destroy Kogi” agenda, having met a brickwall with its “bailout fund plot.”