It is no more news that one Agim Chiamaka took to the social media to call out Zenith Bank over some missing N4 Million from her bank account.

Sadly, further diggings have exposed how she singlehandedly allowed fraudulent activities on her account and in a way to cover up, is blaming it on Zenith Bank Plc.

Recall that Agim Chiamaka on Tuesday, 13 January 2023 shared a video crying at the banking hall over the missing money.

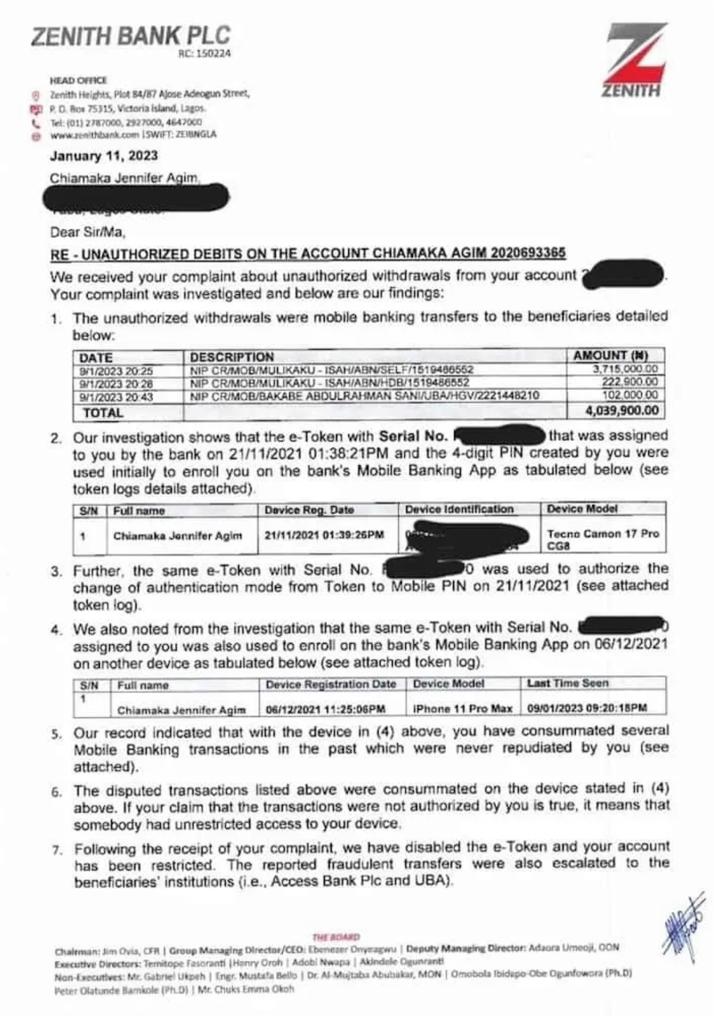

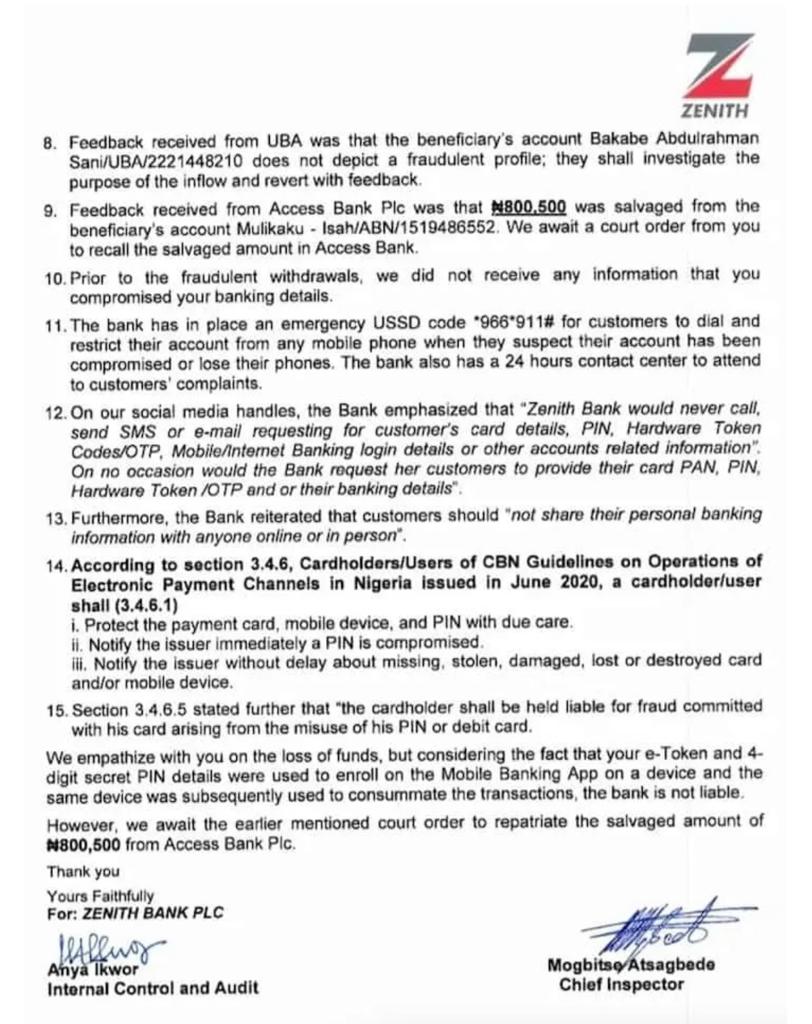

However, Zenith Bank swung into action to investigate how the money was moved from her account to other accounts. The Bank in response to her explained in a two-page investigative report sent to Agim Chiamaka on how her details was compromised to fraudsters using the same device she has used to carry out mobile banking transactions in the past which was never repudiated by the complainant.

According to Zenith Bank “Prior to the fraudulent withdrawals, we did not receive any information that you compromised your banking details. The bank has in place an emergency USSD Code *996*911# for customers to dial and restrict their account from any mobile phone when they suspect their account has been compromised or lose their phones”.

“If your claim of that the transactions were not authorized by you is true, it means that somebody had unrestricted access to your phone”.

Contrary to Chiamaka’s claim of not having a token to initiate her transactions, Zenith Bank investigation shows that her claim is false as she was assigned a token on 21st November, 2021, at 01:38:21PM and 4-digit PIN was created by her (AS REVEALED IN THE ATTACHED MATERIAL) and that she has been using to consummate several mobile banking in the past.

Furthermore, the response letter signed by Internal Control Unit, Zenith Bank noted it can only recover a sum of N800,500 out of the missing sum and advised her on need to get a court order to repatriate #800,500 from Access Bank Plc.

The question is: Did Chiamaka reported to anyone that her mobile phone/Device was stolen?

Where was her device when the transaction took place?

Rather than giving false information, as being speculated by Chiamaka on social media, it is better you (Chiamaka) report this to SPECIAL FRAUD UNIT (SFU) so as to help apprehend the culprits as its obvious that people close to her executed this act.

In lieu of this, I will advise Chiamaka to give full details of where her phone was during the period this transaction took place because investigations show that the same device and the same token assigned to Chiamaka were used to initiate this transaction during the period the fraudulent withdrawal was made.

As against the narratives that have been pushed out to the public, it’s obvious Chiamaka’s carelessness played a huge role in her unfortunate loss. Instead of blaming it on the innocent bank, It will be advisable for her to state the true situation of things to enable swift investigation that may lead to her recovery.