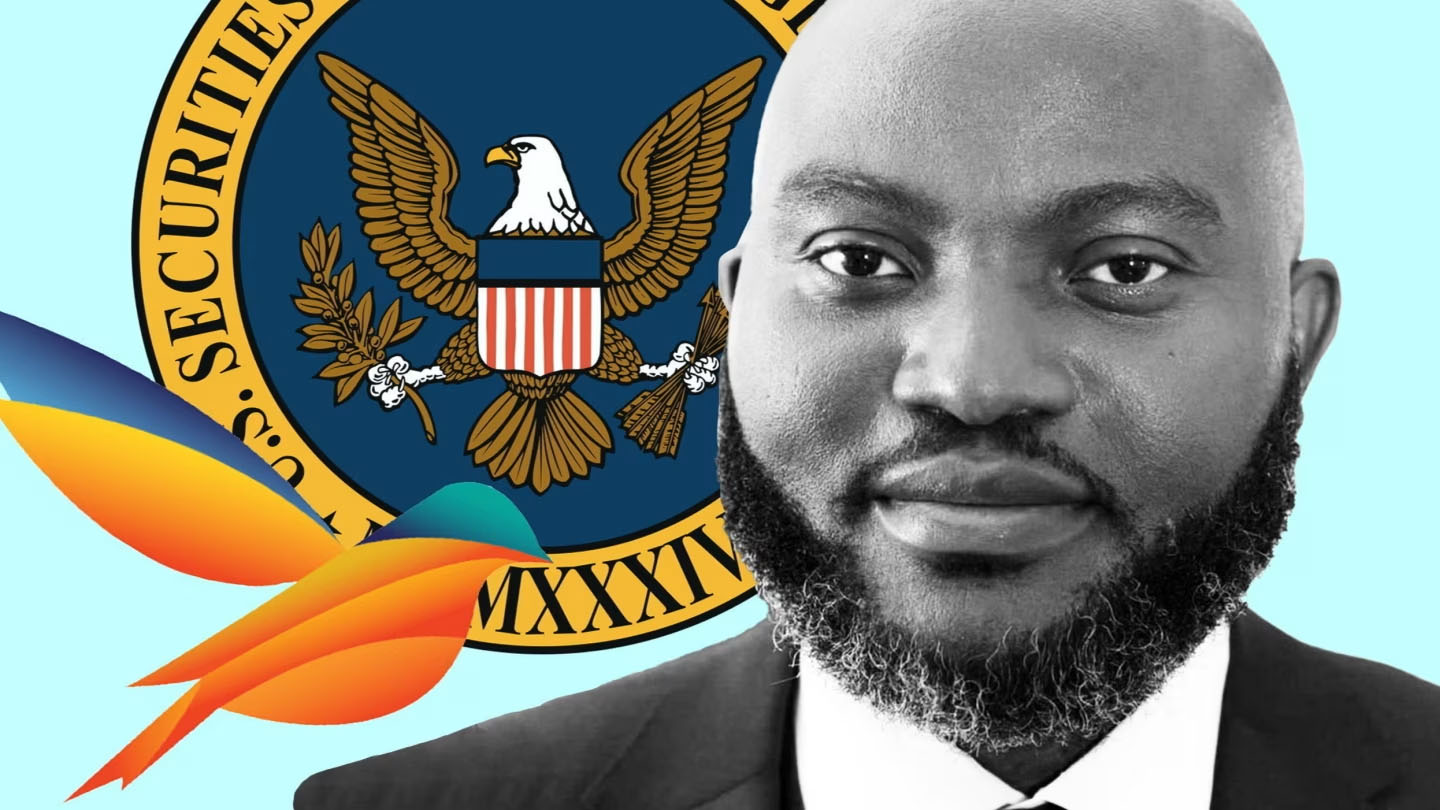

The US government has ordered Mr Dozy Mmobuosi, the CEO of Tingo Group, to pay a fine of over $250 million, months after he was officially charged with securities fraud in New York.

First charged in December 2023, he was accused of orchestrating a massive scheme to inflate the company’s finances as well as artificially boosting financial statements to make Tingo and its subsidiaries appear liquid.

The US Securities and Exchange Commission (SEC) claimed that “since at least 2019, Mr Mmobuosi spearheaded a scheme to fabricate financial statements and other documents of the three entities and their Nigerian operating subsidiaries, Tingo Mobile Limited and Tingo Foods PLC.”

Now, Judge Jesse M. Furman of the US District Court for the Southern District of New York ordered Mr Mmobuosi and his three US-based entities – Tingo Group, Agri-Fintech Holdings, and Tingo International Holdings – to pay more than $250 million in fines.

He was also barred from serving as a director of any public company. This does not extend to Nigeria, where he has some other businesses, which are not listed.

“The judgments, entered on the basis of default, enjoin Mmobuosi, Tingo Group, Agri-Fintech Holdings, and Tingo International Holdings from violating the anti-fraud provisions of Section 17(a) of the Securities Act of 1933 and Section 10(b) of the Securities Exchange Act of 1934 and Rule 10b-5 thereunder,“ the SEC said.

In March, the US SEC froze Mr Mmobuosi’s assets, as well as stop Tingo and its subsidiaries from transferring money or property or issuing shares to Mmobuosi and restricted the defendants from selling or otherwise disposing of their respective holding in Agri-Fintech and/or Tingo Group stock.

It was alleged that legitimate bank records from the company showed less than $50 in comparison to the $461.7 million it reported in one of its filings to the exchange where it traded its stocks.