The ongoing internal crisis at FBN Holdings Plc, the parent company of First Bank of Nigeria Limited, has raised concerns among stakeholders that the bank’s collapse is imminent.

The unresolved governance and strategic disputes have prompted calls for urgent intervention from regulatory agencies including the Central Bank of Nigeria (CBN) and the Securities and Exchange Commission (SEC).

Patrick Ajudua, National Chairman of the New Dimension Shareholders Association, emphasized the need for regulatory intervention, stating that the regulator must ensure that rules and laws are strictly followed to resolve the disputes.

“The regulator owes it a duty to ensure that rules and laws are strictly followed in resolving the various contending issues currently rocking FBN Holdings Plc. Failure to do so may lead to the collapse of the bank, eventually resulting in a regulatory takeover and the loss of our investment,” he warned.

The crisis has sparked fears about the potential consequences for Nigeria’s financial system.

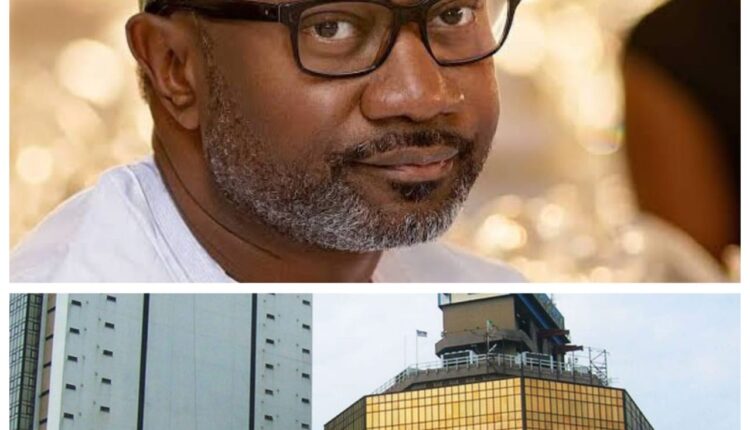

A group of shareholders holding 10 per cent of the company’s shares on Wednesday formally requested an Extraordinary General Meeting, citing Section 215(1) of the Companies and Allied Matters Act (CAMA). Among the agenda items are calls for the removal of Group Chairman Mr. Femi Otedola and Mr. Julius B. Omodayo-Owotuga, a non-executive director.

The shareholders alleged that Otedola’s emergence as chairman was facilitated by former Central Bank of Nigeria Governor Godwin Emefiele, who reportedly supported Otedola’s acquisition of substantial shares.

They claimed that this development has since disrupted the bank’s governance structure, leading to instability and executive conflicts.

Further accusations include the dismissal of former CEO Dr. Adesola Adeduntan, the sidelining of Tunde Hassan-Odukale, and the alleged bypassing of top-performing candidates for key leadership positions.

The resolution of FBN Holdings Plc’s challenges is crucial not only for the institution but also for maintaining investor confidence and safeguarding the broader financial sector.

Stakeholders are now looking to regulatory authorities to restore stability and uphold the principles of corporate governance.

A swift intervention by the CBN and SEC could help prevent the escalation of the crisis and restore stability in the country’s financial system.

In recent years, the CBN has demonstrated its willingness to intervene in the banking sector to prevent instability.

For instance, in 2021, the CBN sacked some members of the board of First Bank of Nigeria Limited and FBN Holdings PLC due to concerns about corporate governance and regulatory infractions.

The outcome of this crisis will serve as a litmus test for the resilience of Nigeria’s banking industry and its ability to manage governance challenges effectively.

As stakeholders await further developments, it is clear that decisive action is needed to prevent a potentially catastrophic outcome.