The positive trend was driven by sustained investor interest in heavyweight stocks such as Aso Savings, Ikeja Hotel, Regency Alliance Insurance, Caverton Offshore, Aradel Holdings, and others.

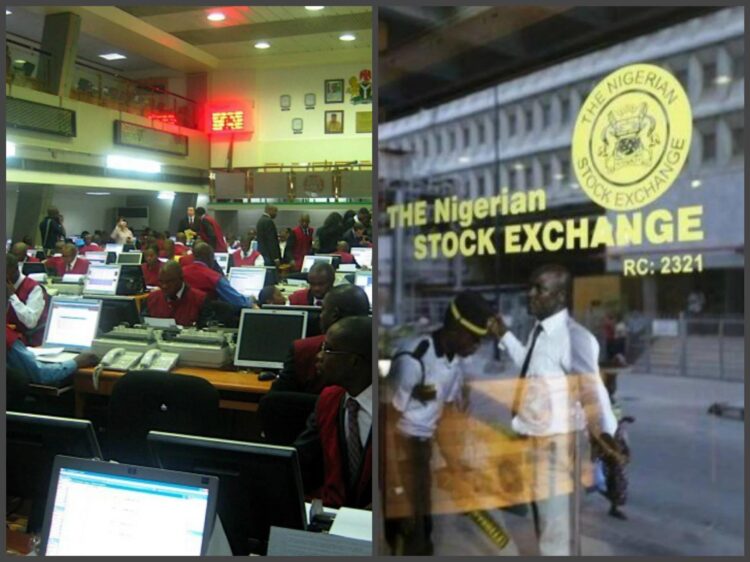

The Nigerian Exchange Ltd. (NGX) market capitalisation rose from N98.059 trillion at opening to N98.792 trillion at Friday’s close.

Similarly, the All-Share Index (ASI) advanced by 0.75 per cent or 1,155.15 points, closing at 155,645.05 compared to 154,489.90 recorded on Thursday.

Market breadth closed positive with 34 gainers and 25 losers recorded during the session.

Aso Savings led the gainers’ chart by 10 per cent, ending at 66k. Ikeja Hotel rose 7.89 per cent to N20.50, while Regency Alliance Insurance increased 7.44 per cent to N1.30.

Caverton Offshore advanced 7.08 per cent to N6.50, and Aradel Holdings appreciated 6.76 per cent to N790 per share.

Conversely, Union Dicon Salt led the losers’ table by 9.09 per cent, closing at N8. Neimeth Pharmaceutical fell 6.67 per cent to N5.60, while Cornerstone Insurance dropped 5.61 per cent to N6.23.

Halldane McCall declined 4.84 per cent to N4.13, and International Energy Insurance shed 4.48 per cent to N2.77 per share.

Market activity showed growth in turnover and volume, though the number of deals fell slightly.

A total of 1.21 billion shares worth N31.5 billion were traded across 29,989 deals, compared to 926.9 million shares worth N26.9 billion across 30,703 deals.

Fidelity Bank led the activity chart with 820.9 million shares valued at N16.14 billion.

Sovereign Trust Insurance followed with 45.5 million shares worth N176.96 million, while Tantalizer traded 32.7 million shares valued at N72.05 million.

Access Corporation transacted 23.8 million shares worth N593.4 million, and Guaranty Trust Holding Company traded 19.2 million shares valued at N1.78 billion.