First HoldCo Plc (“FirstHoldCo” or “the Group”) has announced that its commercial banking subsidiary, First Bank of Nigeria (FirstBank), has successfully met the Central Bank of Nigeria’s (CBN) minimum capital requirement of ₦500 billion.

This milestone was achieved following the completion of a series of strategic capital initiatives, including a Rights Issue, a Private Placement, and the injection of proceeds from the divestment of the Group’s merchant banking subsidiary.

This successful capitalisation underscores strong market confidence in FirstHoldCo Group’s business model, long-term strategy, and growth prospects. With a fortified capital base, FirstBank is positioned to accelerate its support for the real sector, enhance financial inclusion, and deliver innovative, digitally driven customer experiences.

The recapitalisation strengthens the Group’s overall financial resilience, providing a robust platform for earnings growth through business expansion, technological innovation, and the pursuit of new opportunities.

In March 2024, the CBN directed commercial banks to raise their capital base to a minimum of ₦500 billion within a 24-month period to bolster the Nigerian banking sector’s stability and capacity. FirstBank has now fulfilled this requirement well ahead of the regulatory deadline.

In a related development, FirstHoldCo have expressed its desire to raise fresh funding and inject additional capital into the Group’s existing subsidiaries and new business adjacencies in 2026. This forward-looking commitment is aimed at further enhancing service offerings and facilitating strategic expansion.

Commenting on the achievement, Mr. Femi Otedola, CON, Chairman of First HoldCo Plc, said: “On behalf of the Board, I extend our profound gratitude to our shareholders for their trust and unwavering support throughout this capitalisation programme. From the oversubscribed Rights Issue to the seamless Private Placement, investors have demonstrated resounding confidence in our strategic direction. Securing FirstBank’s capital base ahead of schedule is a testament to our collective commitment and positions us firmly for our next growth phase. We also appreciate the professional guidance of the CBN and SEC throughout this process.”

Mr. Wale Oyedeji, Group Managing Director of First HoldCo Plc, added: “This successful capital raise is a pivotal milestone for FirstHoldCo. It provides us with the financial strength to execute our core strategic priorities: driving innovation, delivering superior customer value, and enhancing sustainable profitability. With this solid foundation, we are focused on accelerating performance, improving competitive returns, and delivering lasting value to all our stakeholders.”

About FirstHoldCo Plc

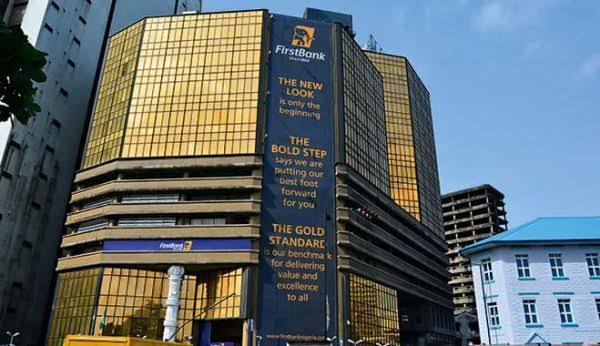

First HoldCo Plc is a Lagos-based financial services group building a more inclusive and sustainable financial future. Our diversified structure encompasses banking, asset management, insurance brokerage, and capital markets operations. By combining strategic oversight with a commitment to innovation and integrity, we enable our subsidiaries to deliver superior solutions and service. Every facet of our business is driven by a vision to generate lasting stakeholder value through responsible, high-performance growth.