Kenya began selling a 65 per cent stake in its state oil pipeline firm on Monday, aiming to raise 106.3 billion shillings ($825 million) in its biggest-ever initial public offering.

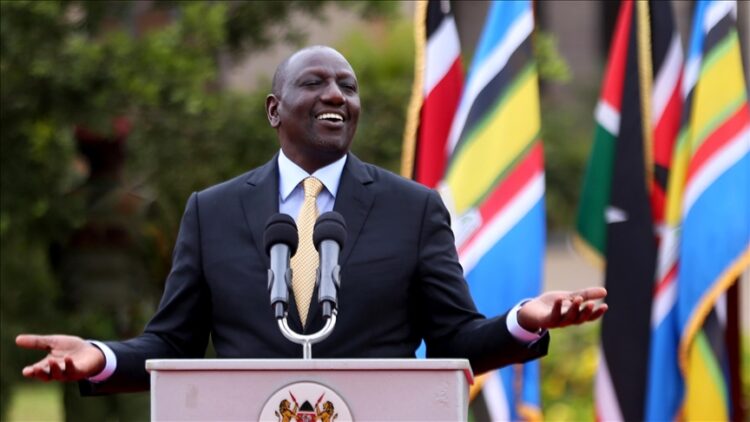

The sale is part of a drive by President William Ruto’s government to divest from state companies to raise funds for new infrastructure and sovereign wealth funds.

It is also reducing its stake in telecoms operator Safaricom (SCOM.NR).

The government priced the IPO in Kenya Pipeline Company at nine shillings per share, the offer documents showed. The sale will run until February 19, and the shares will be listed for trading on the Nairobi bourse on March 9.

The Kenya Pipeline IPO will be the regions biggest, topping an initial sale of Safaricom shares to the public in 2008 when the government raised 50 billion shillings.

It came amid a global recovery in equity capital markets and as stock markets hit record highs.

Equity capital markets activity totalled 738.4 billion dollars in 2025, up 15 per cent year-on-year, marking the strongest annual period for global equity capital markets activity in four years, according to LSEG data.

Just over a fifth of that was raised through equity capital markets offerings by issuers in Europe, the Middle East and Africa. ($1 = 128.9000 Kenyan shillings)