President Tinubu is set to restructure the tax system with new reforms that will scrap the Federal Inland Revenue Service (FIRS) and replace it with the Nigeria Revenue Service (NRS).

Meanwhile, recall that Speaker of the House of Representatives, Hon. Tajudeen Abbas on Thursday confirmed receipt of four tax reform bills transmitted by President Bola Tinubu for consideration and quick passage.

Abbas who presided over the plenary, explained that the proposed bills were designed in line with the objectives of the present administration explained that the Nigeria Tax Bill 2024, seeks to provide the fiscal work for tax in the country and a tax administration bill that will provide clear and concise legal framework for all taxes in the country and reduce disputes.

A bill to repeal the FIRS Act and establish the NRS was forwarded by the President to the Senate on Thursday.

It was one of four tax reform bills Tinubu sent to senators in a letter the President of the Senate, Sen. Godswill Akpabio, read to his colleagues during plenary in Abuja.

The proposed NRS, according to the letter, will “assess, collect, and account for revenue accruable to the government of the federation.”

There is also the Nigeria Tax Bill, which the President said “provides a consolidated fiscal framework for taxation in Nigeria.”

A third bill, “The Nigeria Tax Administration Bill, “provides a clear and concise legal framework for the fair, consistent, and efficient administration of all the tax laws to facilitate ease of tax compliance, reduce tax disputes, and optimize revenue.”

Another bill, The Joint Revenue Board (Establishment) Bill”, seeks to establish “the Joint Revenue Board, the Tax Appeal Tribunal, and the Office of The Tax Ombudsman for the harmonization, coordination, and settlement of disputes arising from revenue administration in Nigeria.”

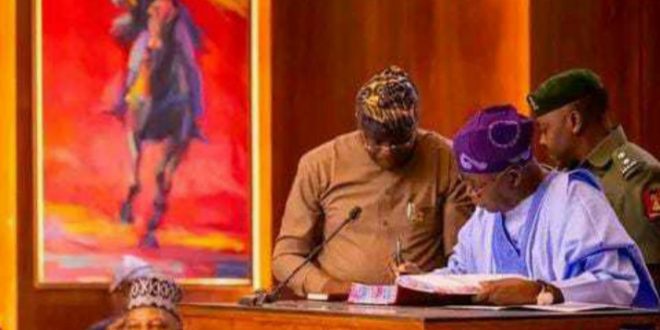

Tinubu’s letter reads partly, “I write to forward herewith the Fiscal and Tax Reform Bills by the Federal Inland Revenue Service for consideration and passage by the Senate.

“i. The Nigeria Tax Bill: provides a consolidated fiscal framework for taxation in Nigeria;

“ii.The Nigeria Tax Administration Bill: provides a clear and concise legal framework for the fair, consistent, and efficient administration of all the tax laws to facilitate ease of tax compliance, reduce tax disputes, and optimize revenue.

“The Nigeria Revenue Service (Establishment) Bill: repeals the Federal Inland Revenue Service (Establishment) Act, No. 13, 2007 and establishes the Nigeria Revenue Service to assess, collect and account for revenue accruable to the government of the federation;

“iv. The Joint Revenue Board (Establishment) Bill: establishes the Joint Revenue Board, the Tax Appeal Tribunal, and the Office of The Tax Ombudsman for the harmonization, coordination, and settlement of disputes arising from revenue administration in Nigeria.

“The proposed tax bill presents substantial benefits to a library, government connectives, and economic growth by enhancing taxpayers’ compliance strengthening fiscal institutions, and fostering a more effective and transparent fiscal regime

“I am confident that the bill when passed will encourage investment, boost consumer spending a s stimulate Nigeria’s economic growth.”