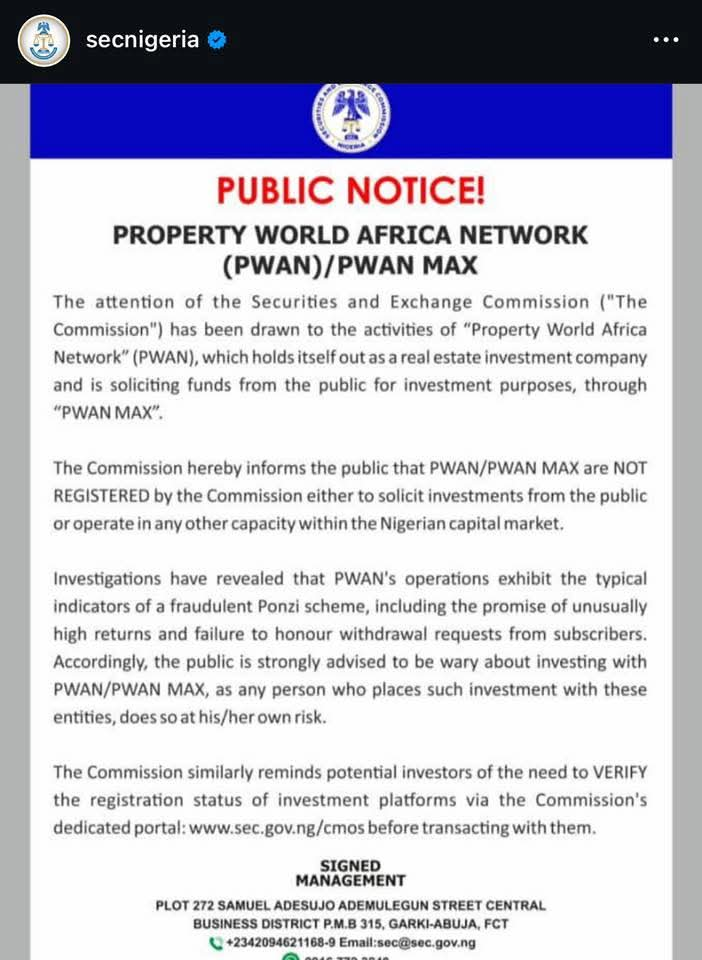

The Securities and Exchange Commission has issued a stern warning to the public regarding the operations of Property World Africa Network, also known as PWAN MAX, which has been soliciting funds from unsuspecting investors under the guise of a real estate investment company.

The SEC noted that PWAN MAX is not registered with the Commission to operate in any capacity within Nigeria’s capital market, raising serious concerns about the legitimacy of its activities.

In a public notice released on Tuesday via its official Twitter handle, the SEC said that investigations into PWAN’s operations uncovered characteristics typical of a fraudulent Ponzi scheme.

The Commission highlighted red flags such as promises of unusually high returns and the company’s failure to honour withdrawal requests from subscribers.

“The Commission hereby informs the public that PWAN/PWAN MAX are NOT REGISTERED by the Commission either to solicit investments from the public or to operate in any other capacity within the Nigerian capital market,” the statement read.

The SEC’s warning comes amid growing concerns about unregulated entities exploiting investors in Nigeria’s financial markets.

The Commission emphasised the risks associated with investing in unregistered platforms, stating, “The public is strongly advised to be wary of investing with PWAN/PWAN MAX, as any person who places such investment with these entities does so at his/her own risk.”

It noted that the caution underscores the need for due diligence among investors to avoid falling victim to fraudulent schemes.

The SEC urged potential investors to verify the registration status of any investment platform before committing funds.

The Commission directed the public to its dedicated portal at www.sec.gov.ng/cmos for this purpose.

“The Commission similarly reminds potential investors of the need to VERIFY the registration status of investment platforms via the Commission’s dedicated portal,” the statement noted, reinforcing the importance of transparency and accountability in financial dealings.

This development follows a series of efforts by the SEC to clamp down on unregistered and fraudulent investment schemes in Nigeria.

The Commission has repeatedly called on the public to exercise caution and conduct thorough checks before engaging with entities promising high returns.

It said, “Investors are urged to heed the Commission’s warning and avoid transacting with PWAN MAX to protect their financial interests.”

However, reacting to the SEC’s position in a public statement released on Wednesday, PWAN Group said that its buy-back model is a private commercial agreement between the company and individual clients, aimed at enabling participants to benefit from the capital appreciation of real estate assets.

The statement read: “Our Real Estate Buy-Back transactions are forward-thinking, contract-based engagements, directly tied to verifiable physical properties.

“This model does not constitute a capital market product and, based on legal counsel, does not currently fall under any defined regulatory category within SEC’s existing framework.”

PWAN Group reiterated that the scheme does not involve pooling of funds, unrealistic returns, or reliance on continuous inflows to sustain payouts—features that are typically associated with Ponzi operations.

“There is no element of Ponzi in our model,” the company stressed. “Every transaction is backed by a registered and traceable property. Clients know exactly what they’re paying for and what they’re getting.”

The company also noted that the Buy-Back model was born out of its business philosophy of “shared prosperity”, aimed at extending the benefits of real estate value growth to clients across its over 1,000 estate projects nationwide.

While expressing its willingness to comply with regulatory expectations, PWAN Group urged the SEC to provide clearer guidelines if such transactions are to fall under future regulatory oversight.

“We remain a law-abiding corporate entity and are fully committed to cooperating with regulatory authorities. Should the SEC now or in the future provide a clear classification or registration framework for this type of transaction, we will promptly align our operations accordingly,” the statement added.