The Lagos State House of Assembly has approved Governor Babajide Sanwo-Olu’s request of ₦85 billion special dispensation for bond redemption as well as ₦85 billion for bridge loan for a quarter.

This is in pursuant to the approval of Bonds, Loans and other Security Law of Lagos State 2015 and comes at 9.25% per annum to bond financing programme.

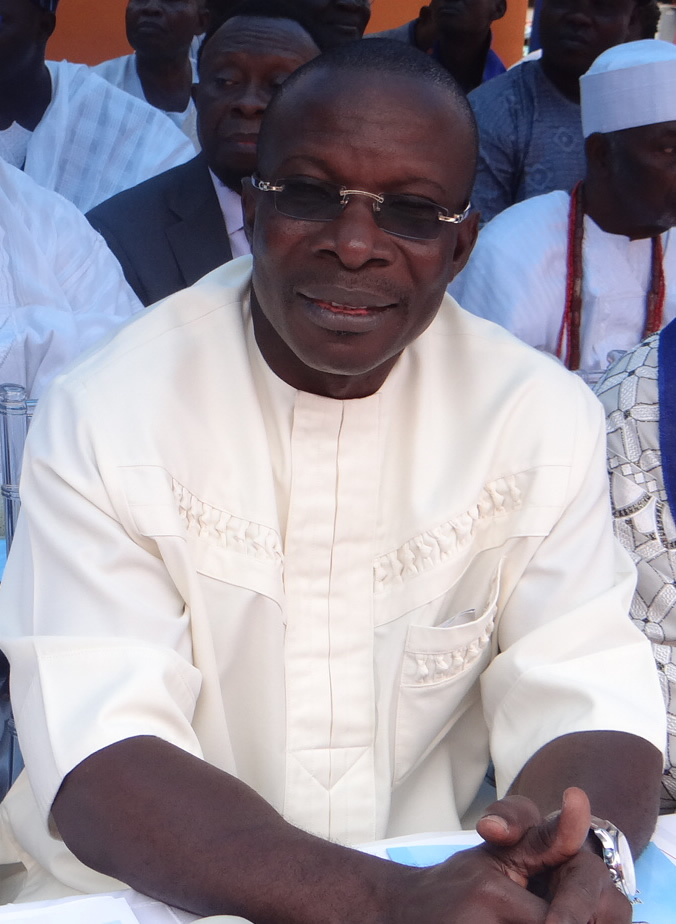

At a sitting on Monday, the Chairman of the Committee on Finance, Hon. Rotimi Olowo, stated that the terms of reference of the request received from the executive arm appraise the request for a special dispensation; enquire into the debt profile of the State and ascertain the source of the fund for repayment and refinancing.

According to Hon. Olowo, based on briefing and documents received, the redemption of bonds will allow for extension of maturity of the same with a two years moratorium in 2031 and the special dispensation approval will enable the State earmarks for capital projects.

Addressing journalists after the approval, Hon. Olowo explained that the request from the governor had two aspects.

The first was for an approval for Bond Brigde Loan which would allow the state to access bond market as soon as possible while the second aspect is a loan from a commercial bank at the interest rate of 9.25.

Olowo explained that as at February this year, the federal government went to bond market at coupon rate of 12% , saying that in june it had increased to 13.5%.

He also said comparing the rate with the bond secured by the state government in 2016 and 2017, the least of all was 16.6%, adding that the highest was around 17.25%.

Olowo explained that the opportunity the market provided was enough for the state to access it now, adding that the state would be able to get the rate cheaper and that the current bond of the state would mature in 2024.

“When you look at our Consolidation Debt Service Account (CDSA) we have about N22billion and we are talking N101.2billion in the next 2 or 3years. It will amount to a lot of pressure on our debt obligation, so what we thought that is necessary is that we should quickly access the bond market with the approval of the House so that we can get it at cheaper rate and it will be for 10years with 2years moratorium.

“What it means is that, in the next two years after securing the bond we will not pay any money. We will not pay the interest and the capital, it will be like tax holiday. It will relieve the state the burden of sourcing for money to pay the creditors.

“On the second aspect, if today we don’t access the commercial loan from one of the banks at a single digit of 9.25%, we will still be losing because what we will still access, we will pay the holders of the bond between now and the next one months. That means we have been able to save money worth an average of N1.5billion in form of seeking fund to be able to make up to 2023.

“So, if we don’t pay that in the next three years, what it means is that we have gotten a saving of about N75billion. It is obvious that there cannot be a better time for the state to go for the bond market which we called ‘ Special Dispensation Bond’ and the second is a loan from a commercial bank at the interest rate of 9.25 which is very cheap. That is the reason why the Assembly speedily supports the executive. We always want to support the executive when it comes to infrastructure,” Olowo said.