- How MD son allegedly siphon N150bn farmer funds

- The CBN Gov. Emefiele connection

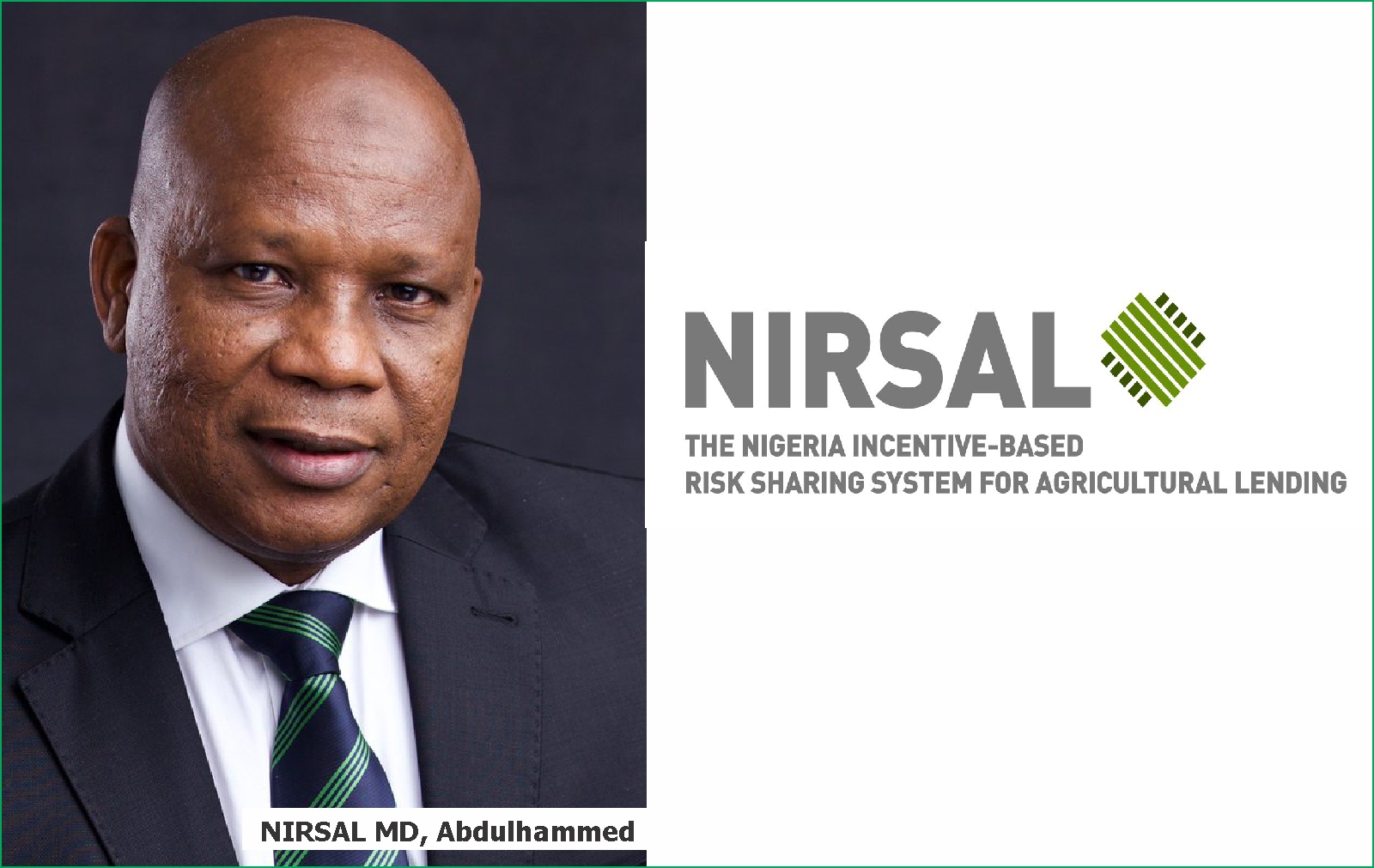

An alleged monumental fraud involving a whopping sum of N150billion is currently rocking the Nigeria Incentive-Based Risk Sharing System for Agricultural Lending, popularly known as NIRSAL, with the Managing Director, Aliyu Abbati AbdulHameed; son, Imran and cronies in the agency accused of looting the intervention fund meant for farmers in the past five years.

In a detailed investigation by First News, NIRSAL MD and his allies allegedly fraudulently rake in about N204, 203,000million on a monthly basis and a total sum of N2,450,436,000billion annually from the payroll of the consultants engaged at the 37 Project Monitoring and Remediation Offices.

The fraud allegedly perpetrated by AbdulHameed, his son and some top officials and senior consultants to the agency, we learnt, is already causing disquiet among the staff in its head office located in Abuja, the Federal Capital Territory.

But inspite of this large scale allegations of corruption, First News learnt that the NIRSAL MD has been enjoying some protection from investigation and prosecution by the Attorney General of the Federation and Minister of Justice, Abubakar Malami and the Governor of the Central bank of Nigeria, Mr Godwin Emefiele, who is the chairman of the Agency’s Board.

NIRSAL was incorporated in 2013 by the Central Bank of Nigeria with a take-off grant of $500million and given the mandate to de-risk agriculture and promote credit to the sector from the commercial banking system. But going by the happenings within the agency in the past five years, NIRSAL, according to financial analysts, has allegedly become another conduit for corruption and fraud.

The NIRSAL MD, whose five-year tenure officially lapsed since December 2020, First News gathered, once awarded to his son, Imran Aliyu AbdulHameed, N2billion contract for the purchase of MacBook Air laptops, iPhones, drones, and ICT software for the staff of the agency.

AbdulHameed and his cronies at NIRSAL are alleged to have also purchased a number of choice properties for his son, Imran in Dubai and elsewhere across the world.

He is also alleged to be in the habit of grossly violating due process in the disbursement of the agency’s funds. It was learnt that there is a backlog of operating and capital expenditures already approved by him but which are above his approval limits and for which no board approval was obtained. Most of such contracts said to be worth tens of billions of Naira were never executed, it was learnt.

The NIRSAL MD, it was learnt, caused the agency to invest directly in a number of projects called Farmsmart, which gulped the sum of N402, 521,056million but were allegedly deliberately designed to fail.

These projects, which were scheduled for execution in 10 states, it was learnt, have now been reclassified by the agency as “technical assistance” (also known as proof of concept projects) to allow the funds to be written off. Two of companies involved in the failed project are: SCAGRIC Ltd and Tradeco Ltd, which got investment worth N348.2 million and N54.3 million, respectively, from NIRSAL.

The NIRSAL MD is also allegedly said to have been using the agency’s Head of Finance, Idris Issa Aweda, as a conduit for receiving alleged proceeds of fraud through three personal bank accounts: FCMB (4986133010), GTB (0245155058), and Stanbic IBTC.

Despite not being a security agency, the NIRSAL boss, First News further learnt, has in the past years allegedly been ordering the payment of hundreds of millions of Naira for such phantom items under different headings, including “Advance for security challenge in the North-East on the farms fields”, “Security challenge in the North- Central on the farms fields”, “Advance for external security issue armoured car” and “Advance for security challenge in the South-East on the farms fields”.

These illegal funds, it was learnt, are directly wired into the private bank accounts of the NIRSAL head of finance, Aweda. It was gathered that he allegedly received in his personal accounts the sum of N784,549,773.45 between August 2017 and October 11, 2019 as security imprests and other expenses.

The NIRSAL MD, it was learnt, allegedly procured illegally two armoured vehicles (Toyota Landcruiser JTMHX09J5F4083758 and Lexus LX 570 JTJHY00W2J4260990) at the cost of N180million without approval from the Office of the National Security Adviser. These are in addition to the nine official vehicles allocated to him in various locations across the country.

The proceeds from these financial crimes, we learnt, have been used by the NIRSAL MD to acquire choice properties, including a hotel and resort in South Africa as well as exotic automobiles in different states in Nigeria and countries across the world through his Personal Assistant, Muhammed Abdulkadir, and the agency’s National Coordinating Consultant on Project Monitoring and Remediation Offices (PMRO), Dr. Olusegun Steven Ogidan, under the name of his cronies.

Some of the properties which purchase was allegedly facilitated by Abdulkadir for the NIRSAL MD include mansions in Maitama, Katampe, Eko Atlantic, Lagos, Germany (through one Baba Ali), the United Kingdom, Dubai, and South Africa as well as a massive plot of land on Airport Road, Abuja, formerly owned by Diff Hospital, and a farmland in Gembu, Taraba State.

NIRSAL’s consultant on PMRO, Ogidan, it was learnt, has been used by the agency’s MD, AbdulHameed to divert over N30billion from NIRSAL’s coffers, which he has allegedly diverted to purchasing choice properties both within and outside Nigeria.

Ogidan, we gathered, is solely in charge of all NIRSAL’s operations across the 36 states and the Federal Capital Territory, Abuja, through his company, Successory Limited, with headquarters at 54B Abidjan Street, Wuse Zone 3, Abuja. Ogidan is also the owner and a director of Beresh Consulting, also registered in South Africa. The company also has Aluko Akinyele Oluwole, Makolo Samuel Omakoji, and Bamigboye Anthony Akinloye as directors. But while Akinyele is the coordinator of NIRSAL PMRO in the South West, Samuel also work as a PMRO consultant in the same agency.

Findings revealed that in the past four years, the NIRSAL MD has used Ogidan to divert a total sum of N8.5billion with over N204million and N2.4billion, respectively, illegally taken from the agency’s coffers monthly and annually.

“This is done through the ghost-worker scheme and slashing of PMRO staff salaries. The total amount of money being spent by the Central Bank on PMRO monthly is about N309million. This is allocated to the 12 Zonal Coordinating Consultants (ZCCs) in charge of the 36 state offices across the country. Head PMROs receive the sum of N350,000.00 as monthly salary instead of N850,000.00 as outlined in the subsisting contract representing 41 per cent of salary sum payable. This implies that the sum of N181million, representing 59 per cent of funds due to PMRO is continually diverted on a monthly basis since inception,” a top official of the agency said.

The NIRSAL MD, it was learnt, has also allegedly used Ogidan to repatriate millions of dollars to the Middle East, South Africa, United States, and Europe, where such illegal funds had been invested in the purchase of choice properties, luxury vehicles and other items, including a five star resort in South Africa, Vivari Hotel, where substantial shares of the hotel were purchased for the sum of $5million. The NIRSAL national coordinating consultant is a shareholder and a director of the hotel located at 30 Bryanston Drive, Sandton, Johannesburg.

The NIRSAL funds are laundered and repatriated abroad by Ogidan through an Utako, Abuja based microfinance bank said to be virtually under the control of the NIRSAL MD, to escape detection.

Three other companies also owned by Ogidan, including Successory Nigeria Limited, Beresh Consulting and Global Knowledge, are also allegedly used to perpetrate fraud at NIRSAL.

Ogidan’s Beresh Consulting registered in South Africa, it was learnt, was once awarded over N2billion contract by NIRSAL to organise a training programme for 100 of its staff in Johannesburg.

It was further learnt that NIRSAL expends the sum of N40million to organise training session every quarter for key persons from every PMRO, but much of the fund is allegedly diverted by Ogidan.

“For instance, a Head of PMRO is entitled to the sum of N57,600 per night (N172,800 for 3 nights) as duty tour allowance, but ends up being paid N20,000 (N60,000 for 3 nights) – the sum diverted in this case is calculated as N8,288,000 (i.e. N112,000 X 74 attendees) per event. The bulk of the money (N21 million) is usually spent on training manuals that are never printed (5,200 copies at the rate of N4,200 each),” a source at NIRSAL told First News.

The NIRSAL boss, AbdulHameed, First News also gathered, maintains a permanent apartment in Ikeja, Lagos, allegedly owned by him but for which the agency pays N60million rent on a yearly basis.

Audit inquiry by Keystone Bank in 2019 over the diversion of the sum of N5.488billion budgeted for NIRSAL’s 20,000-hectare wheat project in Kano and Jigawa allegedly indicted the agency’s MD, AbdulHameed, and his Senior Technical Assistant, Oluwatosin Ariyo, who executed the dry season project and Ogidan, the national coordinating consultant.

Ariyo, it was gathered, who is one of the major conduit allegedly used by the NIRSAL MD to syphon, also serves as a signatory to many of the agency’s accounts with commercial banks, which have allegedly been used fixed deposit investments and the diversion of the interest accruing to the fixed deposits. The funds raked in from these illegal transactions are allegedly kept in accounts directly controlled by Ariyo.

“An example is over N4 billion invested, at one time, in fixed deposit with the old Skye Bank (now Polaris Bank). This fixed deposit scheme has been perfected by Mr. Oluwatosin Ariyo and other staff close to the MD as they use this scheme to divert and gain interest on funds released for the Anchor Borrowers Programme,” a reliable source at the agency said.

Keystone Bank audit inquiry found that only about N112,000,000 was actually disbursed to the farm sites in Kano and Jigawa states for the project, leaving a whopping N5.488 billion or 98 per cent of the total project sum diverted to personal use, including the alleged acquisition of a house in the United Kingdom for the NIRSAL MD by Ariyo and one of the friends of AbdulHameed.

A reliable source privy to the report of the Keystone Bank’s inquiry revealed that, “Three companies were responsible for the receipt of the loan, namely: Forest Hill, Mainframe and Woodfarm. However, huge fraud characterized the utilization of the loan as the MD and his cronies perfected a fraudulent act of round tripping the loans meant for farmers for the MD’s personal use. The project is not hinged on NIRSAL’s Anchor Borrowers programme, but on a corporate participation programme. Officers at NIRSAL who planned the programme understood that NIRSAL’S operating guidelines has a single obligor limit which does not allow for a single company to be supported to execute a N5.6 billion project.

“To get around this impediment, the planners engaged these three companies, which then splits the total sum of the project into three with respective amounts not exceeding the single obligor limit of NIRSAL. This is the first grave infringement on this package.

“The Managing Director of NIRSAL, Aliyu Abbati Abdul Hameed, has substantial business interests in at least two of the companies. The arrangement was for the three companies to work out for respective agricultural instrument facilities with a commercial bank, which they did, to execute the 20,000-hectare wheat programme. NIRSAL’s role, as defined in the books, is dual: to guarantee up to, but not more than 70% of each of the instrument facilities, and then to also use its Interest-Drawback principle to offset a certain percentage of the interest paid by the borrower to the lending bank so long as the borrower is quarterly up to date with its loan obligations.”

He added: “Keystone Bank offered the instrument facilities to the participating companies squarely as an agricultural facility for a wheat production programme. The participating companies “approached” NIRSAL for its dual role of guaranteeing such loans, as well as for the application of its InterestDrawback principle. NIRSAL got involved, and then Keystone began its disbursements to the participating companies (loanees). The administrative setting is done with, and the field work for a wheat production set to commence.

“A short length into the field work, Keystone Bank observed actions which may be defined as potential infringements of the agreements entered into between it and the three companies, variously.

Keystone Bank, in July 2019, then launched an audit enquiry into its dealings with the three companies. Keystone Bank was concerned that the terms of its dealings with Forest Hill Agricultural Development Limited, for instance, had been breached, and so the Bank had stopped further transfers of funds between Forest Hill and its other partners.

“In the present instance, Forest Hill had requested Keystone Bank to transfer, from Forest Hill’s account, the sum of five hundred and forty-three million naira (N543,000,000.00) to Mainframe, to cover for expenses incurred by Mainframe on behalf of Forest Hill on the wheat project under consideration. “…Exceptions noted in our enquiry” is what Keystone Bank stated as reason for declining further transfer transactions between Forest Hill and Mainframe.

The source further stated, “Keystone Bank noted these exceptions as: (1) That Forest Hill had “mentioned” that it had cultivated and harvested 1,060 hectares of wheat in the initial planting season which ended April 2019, which was in line with the approved transaction cycle. However, the sales proceeds for this harvested wheat did not reflect in Forest Hill’s bank account with Keystone Bank, thus violating the irrevocable letter of domiciliation executed by Forest Hill to the effect that all proceeds of the wheat in this programme shall be deposited in the account of Forest Hill domiciled with Keystone Bank. This means that Forest Hill either did not sell the harvested wheat or that it sold the wheat but diverted the proceeds away from Keystone Bank. But Keystone Bank’s enquiry did not find the wheat! This only suggests that the proceeds have been diverted. This is a gross violation of the terms of agreement between the Bank and Forest Hill.

“Equally, Keystone Bank noted that, Forest Hill “mentioned”, during the enquiry, that it planted rice during the period of this contract. This has modified the project scope as there was no rice in the original contract agreement between the Bank and Forest Hill. Keystone Bank was not informed of this modification. Thus, this spells out another gross violation on the part of Forest Hill. Experts say investigators may not buy this explanation, as it will be viewed as diversionary.

“Keystone Bank, in the enquiry, reviewed the Forest Hill’s bank account in question, and then “observed numerous transactions between Forest Hill, Mainframe and Woodfarm,” noting that these transactions “were not as per the approved utilization schedule”, since the companies are separate entities with different directors, which cannot be viewed as a group

“Keystone Bank found that the Forest Hill made out, from its loan account, to pay ACT Agribusiness Limited the sum of three hundred million naira (N300,000,000.00) for Land Preparation and Irrigation (Mechanisation) for a land area of 6,500 hectares. Keystone Bank, in its audit enquiry, found that the agreement between Forest Hill and ACT Agribusiness Limited was for 1,060 hectares. Hence, Keystone Bank required Forest Hill to either provide contract documents obligating ACT Agribusiness to complete the outstanding 5,440 hectares, or that the balance of payment for the outstanding hectares be refunded into the loan account. Investigators know very well that this is one of the commonest methods of stealing public money in Nigeria – documenting “payments” for jobs that are never done, which is a major financial crime.

He also said: “Also, in relation to the mechanisation defence put forth by Forest Hill, Keystone has argued that this actual cost of mechanisation is incurred on behalf of Mainframe. Hence, passing this cost to Forest Hill, as it is in this case, while Forest Hill itself has its own cost of Mechanisation to the tune of N300,000,000.00, would bring the total cost of mechanisation to six hundred million naira (N600,000,000.00). This figure exceeds the five hundred and forty million naira (N540,000,000.00) budgeted for mechanisation in the Utilisation Schedule submitted to the Bank.

“In the case of the purchase of seeds, Forest Hill claims paying N117.45 million. This figure reflects the seeds to cover 6,500 hectares while the mechanisation process was only done on 1,060 hectares. Hence where is the balance payment for the outstanding 5, 440 hectares, since that has not been paid back into the Bank account?

“Mainstreet Capital paid NIRSAL fees and Insurance Premium of N120 million on behalf of Woodfarm Project. Forest Hill, from its loan account, made a refund of this amount to Woodfarm. But both NIRSAL and the insurance company refunded this total amount after cancelling such payments, but such a refund is yet to be reflected in Forest Hill’s account. Suffice to note here that Mr. Oluwatosin Ariyo’s brother is a portfolio manager at Mainstreet Capital.

“There is no doubt that the monies budgeted for the wheat project were laundered. Investigation revealed that the shea seeds bought above were actually bought for a shea butter processing factory in New Bussa, Niger State, owned by Mr Abdulhameed. The Shea butter factory was set up for Mr Abdulhameed by Mr Oluwatosin Ariyo, a Senior Technical Assistant to Mr Abdulhameed. To perfect the criminality, Mr Ariyo used his brother’s company, Agriable Limited, to set up Mr Abdulhameed’s Shea butter company in New Bussa. Agriable Limited is not the only company that Mr Ariyo used to launder NIRSAL money for Mr Aliyu. Sheaco Nigeria Limited is another!

“There is an emphatic allegation that the proceeds from the fraudulent bungling of this wheat project have been channelled, by Mr Ariyo and one other Architect Ibrahim Abdullahi, to buying a house for Mr Abdulhameed in the United Kingdom. Mr Ibrahim Abdullahi is also alleged to have supervised the building of a luxury home for Mr Abdulhameed, in Yola, Adamawa State, with the funds from the bungled Kano-Jigawa wheat project. Mr. Oluwatosin Ariyo was (and possibly still is) a signatory to Mainframe and has signed the bank mandates of Mainframe (the company used for the wheat transaction).”

For instance, the sum of N618 million was single-handedly approved by the MD as cost of design, implementation and management of a call centre and service delivery (N292,247,230.70) and design, implementation and support of enterprise network infrastructure (N326,175,894.37) without the board’s approval. The MD’s approval limit for this category of transaction (capital expenditure) is N20million. The call centre and enterprise network infrastructure do not exist anywhere in the country as at today.

Concerning AbdulHameed’s approval of contracts beyond his limits without carrying along NIRSAL’s Board, an insider told First News, “Contracts worth tens of billions have been awarded by the MD without the jobs or contracts ever done.

One of such is an ERP contract of about N1.3 billion. Other expenses (since 2017) include; N122million training expenses awarded to Wildleaf Ltd., In January 2017, N263 million was awarded to Bamili for Study Tour. In December 2017, N227 Million training expenses was awarded to Bokadi, while N154 Million was awarded to EPMS for General Management. N107 milion was also awarded to Freshvine as Training expense, while Data Acquisition and Software contracts were awarded to inteliwork (N66.2m), Circus Advance (N58m) and Bokadi Links (N55 million).

“In the bid to be compliant with approval limits as from 2019 following years of breaches of approval processes, the Procurement Department guided by the MD resorted to contract splitting; most of these contracts were also never executed. Examples: AVC Capacity Development contract totaling N953m was split into 64 contracts of less than N15m each. In August 2019, AVC Gap Assessment contract which worth N119m was also split into 8 contracts of less than N15m per contract, while in September 2019, Specialized Risk Management Services had its N136 million contract split into 3 contracts.”

We also learnt that the NIRSAL MD, in connivance with the Head of Travel, has allegedly been creating fake travel transactions for the staff of the agency to justify the illegal transfer of hundreds of millions of funds from NIRSAL to some travel agencies without the actual trips taking place.

A NIRSAL senior staff, who pleaded anonymity, said, “Such instances include the disbursement of N1,462,480 for the travels of Oluwatosin Ariyo to South Africa for risk management training and that of Abdulkadir Muhammad for another N1,462,480 made to Alfa Global. Another such fraudulent transaction is that of Imran Aliyu (the son of the MD) for N2,197,000.00 for a First Class return ticket on Emirate Airline from Lagos to Dubai on the 15th of June, 2019. Another such transaction is that of N2,257,087.00 for the same Imran Aliyu for a First Class ticket from Dubai to Munich to Barcelona and then back to Dubai on the 18th of June, 2019, a few days after arriving Dubai.

“Other fraudulent transactions include the payment of funds to the above mentioned travel agencies for the Airtime of the MD that runs into millions of Naira. Samil Asha who is a front of the MD has also been enjoying such travel tours by the MD of NIRSAL through the above mentioned travel agencies. Another Such travel is that of a first class ticket purchased for Aishatu Deal Hamidu, wife of the MD, on Emirates from Abuja to Dubai to Delhi, back to Dubai to Abuja on the 17th of March 2019 by Alfa Global. Multiple of such transactions and fraudulent transactions that never occurred have been used to divert and siphon hundreds of millions of Naira from NIRSAL by the MD.”

However, despite these allegations of large scale corruption and fraud against the NIRSAL MD, First News gathered that he’s being shielded by both Malami and the CBN governor.

It was gathered that none of the petitions written to the two anti-graft agencies – the Economic and Financial Crimes Commission and the Independent Corrupt Practices and Other Related Offences Commission – over the monumental fraud illegal diversion of funds allegedly perpetrated over the years by the NIRSAL MD has ever seen the light of day.

We learnt that a Board Audit Report commissioned by the CBN governor under the chairmanship of the apex bank’s Deputy Governor, Edward Adamu, and which confirmed many of the fraud allegations against the NIRSAL MD, has been suppressed and not implemented by Emefiele inspite of his position as the chairman of the agency’s Board.

Similarly, First News gathered that AGF Malami, in his bid to continue to protect the NIRSAL MD, has forbidden the police from investigating his alleged fraudulent activities at the agency.

AbdulHameed, it was learnt, has been in the habit of engaging the office of the AGF with a view to frustrating any attempt by security agencies to conduct a probe into the alleged large scale fraud at NIRSAL.

AbdulHameed, in a letter written to Malami entitled, “Request for Intervention on Unwarranted and Multiple Investigations of NIRSAL PLC By Law Enforcement Agencies,” with reference NIR/MD/GEN/TAPD/24/20/03, and dated 29th January, 2020, requested the AGF’s intervention in the ongoing investigation of NIRSAL by security agencies.

Following the NIRSAL MD’s appeal to Malami, the Office of the Attorney General, through the Department of Public Prosecution of the Federation, wrote to the Nigeria Police in a letter with reference: DPPA/NIRSAL/110/20, and dated 4th of February, 2020 and forbade the security agency from carrying out any investigation of the alleged fraud at the agency.

Efforts by our correspondent to speak with the NIRSAL spokesperson, Hauwa Noroh-Ali, since Sunday were spurned as she continued to cut the calls put through to her phone after she had refused to reply to text messages sent to her phone on the matter.

On Monday, calls were also put through to the NIRSAL spokespersons phone at about 4:40pm, but after several attempts it was discovered that she had placed our correspondent’s calls on “permanent busy” mode.

Similarly, the NIRSAL National Coordinating Consultant, Ogidan, accused of aiding and abetting the agency’s MD in perpetrating the alleged fraud and serving as his front for the purchase of properties in Nigeria and abroad, refused to pick his calls on Sunday and Monday.

He also did not reply the text messages sent to him since Sunday as of Monday evening.

Source: First News